Debt Collection Resources

How using 3 important documents can help your business.

Written by Nichola Caddy, follow @linkedin

Learn how to minimise your exposure to bad debt by using 3 important business documents.

- Dispute Resolution

- Letter of Demand

- Feedback Form

How 3 business documents can save you money.

1. Disputes Resolution Process

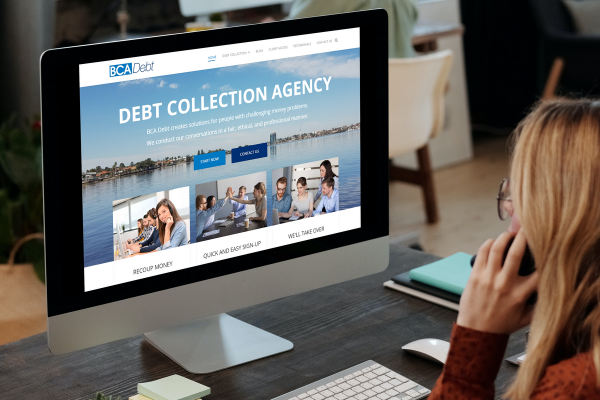

THE FIVE R’S

It is important for your business to have a dispute resolution procedure in place. Without a systematic guide for handling disputes, even the simplest problem can get out of hand.

The Five R’s’ to a successful dispute resolution process

1. Receive the dispute

2. Review the dispute

3. Reiterate to the customer the problem and how you will rectify it.

4. Rectify the problem

5. Revise your procedures to ensure the dispute isn’t repeated.

TEMPLATE INCLUDED

2. Letter of non-payment

Sending a letter of non-payment confirms that your debtor is aware their account is still unpaid and reiterates your intention if they continue not to pay.

If you still don’t receive payment you need to follow through and send the account to debt collection, otherwise, it gives the debtor the impression you are not taking their non-payment seriously.

TEMPLATE INCLUDED

3. Customer feedback form

Customer feedback helps guide you on how well your services are received, it is great to get good feedback about how you are doing.

Sometimes we don't always wow our customers and this is a great way to learn where you can do better. Feedback is critical to learning where you can make decisions about future products and services by being guided by what your customers would like.

TEMPLATE INCLUDED

Get your free guide when you purchase templates.

Resources for Operational Procedures

If you’re in business and supplying credit to customers, chances are that you’ll come across late paying or even non-paying customers. It’s accepted that this ‘comes with the territory but, the truth is, most businesses expose themselves to more credit risk than they need to.

Free Guide: Lessen the impact of non-payment and disputes.

There are many reasons why a business may not be getting paid, in our experience it is usually a dispute over some element of the service or work.

What is in the free guide?

What we have included

This is a system that prevents dissatisfied customers from turning into a nightmare.

- Debtors ledger information

- List of resources every business should include in their operations procedures

- Detailed dispute resolution procedure

- Initial letter of non-payment to send to your debtor

- Forms and letter templates

Resourceful Blogs for You to Read

A common mistake many businesses make is issuing an invoice to a business name.

Who is paying the invoice? Often an invoice is disputed because it has been sent to the wrong person or written out to the wrong entity.

Do your invoices meet the requirements of the ATO.

When it comes to Tax Invoices, as a business you have requirements that must be met. To start with if you are registered for GST your invoice should be referred to as a Tax Invoice if you are not r

Left to Fester

Time and time again we see situations where a debt has been left for so long that the client and customer relationship has broken down. Usually, this happens because someone is not dealing wit